pay indiana state sales taxes

Know when I will receive my tax refund. The state charges a 7 sales tax on the total car price at the.

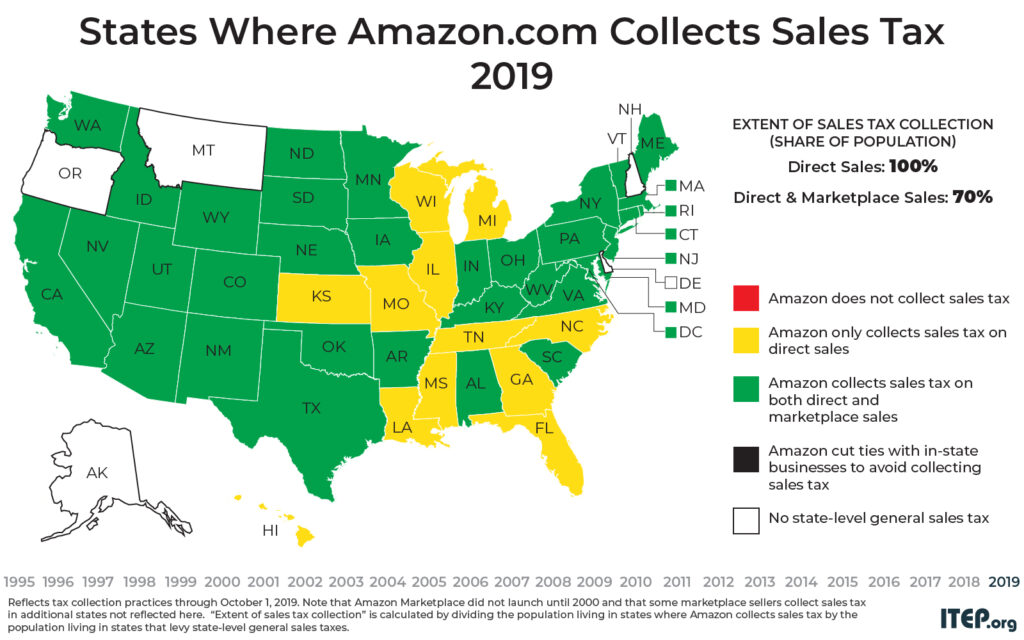

A Lump Of Coal For 12 States Not Collecting Marketplace Sales Taxes This Holiday Season Itep

Any business meeting these qualifications must register with the Department of Revenue.

. The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME which currently offers the ability to manage most tax. Know when I will receive my tax refund. If you sell physical products or certain types of services you may need to collect retail sales tax and then pay it to the Indiana State Department of Revenue.

A person or business engaged in retail sales either personally or through an agent a salesperson or a representative must register to be an Indiana retail. If your business sells goods or tangible personal property youll need to register to collect a seven percent sales tax. INBiz can help you manage business tax obligations for Indiana retail sales withholding out-of-state sales gasoline use taxes and metered pump sales as well as tire fees fuel taxes.

The Indiana Department of Revenue DOR is in the process of moving to its new online e-services portal INTIME which will soon offer all customers the ability to manage tax account s in one. Indiana does not have any local sales taxes so the state-wide rate of 700 applies to all applicable purchases to which sales tax must apply. Most states have a clickable link on this page that shows you which periods are due.

Avalara can help your business. This registration allows you to legally conduct retail sales in the state of. The state of Indiana requires you to pay taxes if youre a resident or nonresident who receives income from an Indiana source.

This makes calculation for. After your business is registered in Indiana you will. The state of Indiana is a bit different for actually getting into the sales tax form.

Groceries and prescription drugs are exempt from the Indiana sales tax. Ad Have you expanded beyond marketplace selling. Indiana has a flat state income tax rate of 323 for the 2021 tax year which means that all Indiana residents pay the same percentage of their income in state taxes.

Calculating sales tax on goods sold in Indiana is easy. When you buy a car you have to pay Indiana sales tax on the purchase plus excise tax to register the vehicle. But the water gets a little murky if your service results intangible personal property.

You are not obligated to pay sales tax in Indiana if you offer a service. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. Indiana State Sales Tax information registration support.

Ad New State Sales Tax Registration. The state defines this as the true. Indiana personal income tax rates.

Ad Have you expanded beyond marketplace selling. Simply charge the 7000 flat sales tax rate on all items whether selling in store or shipping across the. Avalara can help your business.

All Indiana residents pay the same tax rate. This registration can be completed in INBiz. The state income tax rate is 323 and the sales.

Pay online using MasterCard Visa or Discover at the Indiana state government ePay website see Resources. Find Indiana tax forms. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident.

The Indiana state sales tax rate is 7 and the average IN sales tax after local surtaxes is 7. Find Indiana tax forms. The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME to offer the ability to manage tax accounts in one convenient.

To collect the 7 sales tax.

How To Register For A Sales Tax Permit Taxjar

States Without Sales Tax Article

Is It Possible To Buy A New Apple Device Without Any Sales Tax Appletoolbox

States Without Sales Tax Article

When Did Your State Adopt Its Sales Tax Tax Foundation

Economic Nexus By State For Sales Tax Ledgergurus

How To Pay Sales Tax For Small Business 6 Step Guide Chart

A Visual History Of Sales Tax Collection At Amazon Com Itep

Recently Amazon Com Announced That It Would Begin Collecting Sales Tax For Sales In Some States Today From The Vault Money Smart Week Smart Money State Tax

Sales Tax By State Is Saas Taxable Taxjar

How Do State And Local Sales Taxes Work Tax Policy Center

State Corporate Income Tax Rates And Brackets Tax Foundation

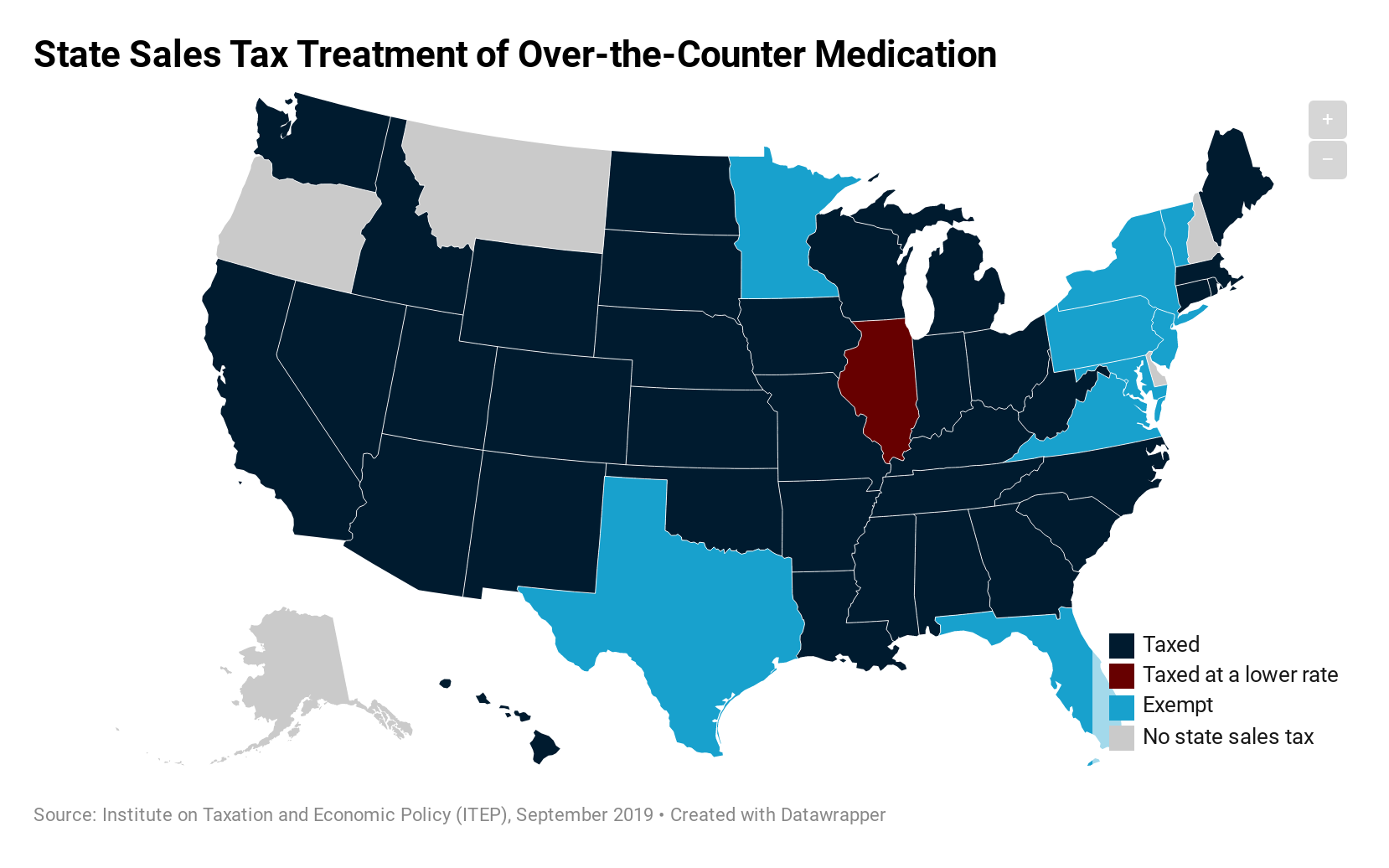

How Do State Tax Sales Of Over The Counter Medication Itep

U S Sales Taxes By State 2020 U S Tax Vatglobal

State Sales Tax Jurisdictions Approach 10 000 Tax Foundation

Indiana Sales Tax Small Business Guide Truic

How Do State And Local Sales Taxes Work Tax Policy Center

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation