how long can the irs legally collect back taxes

Owe IRS 10K-110K Back Taxes Check Eligibility. In most cases the IRS has three years to audit you after you file your return.

Your Tax Refund May Be Late The Irs Just Explained Why The Washington Post

Ad Owe back tax 10K-200K.

. There is a penalty of 05 per month on the. The IRS Settlement process can take six to 24 months. IRC Section 6502 provides that the length of the period for collection.

The IRS is limited to 10 years to collect back taxes after that they are barred by law from continuing collection activities against you. After the agreement is finalized you are done and you no longer owe back taxes. Owe IRS 10K-110K Back Taxes Check Eligibility.

See if you Qualify for IRS Fresh Start Request Online. The IRS will provide up to 120 days to taxpayers to pay their full tax balance. If you did not file.

As already hinted at the statute of limitations on IRS debt is 10 years. The IRS 10 year window to collect. See if you Qualify for IRS Fresh Start Request Online.

Ad Help with Unfiled Taxes Unpaid Taxes Penalties Liens Levies Much More. The IRS ability to collect taxes from you is restricted by the statute of limitations in Internal Revenue Code 6502 a Generally the IRS may only attempt to collect unpaid taxes. The IRS may or may not leave you.

Ad Owe back tax 10K-200K. Ad 4 Simple Steps to Settle Your Debt. The ten-year time period in which the IRS can collect back taxes begins on the date an IRS official signs the tax assessment.

Failing to pay your taxes may lead to IRS collection activities. GET PEACE OF MIND. IRM 557 Collecting Estate and Gift Tax Accounts provides additional information on collection of estate tax accounts and the CSED.

Get Your Free Consultation. This means that the maximum period of time the IRS can legally collect on back. In general the Internal Revenue Service IRS has 10 years to collect unpaid tax debt.

Generally under IRC 6502 the IRS will have 10 years to collect a liability from the date of assessment. See if You Qualify For Tax Payer Relief Program. Theres no fee to request the extension.

If the IRS shows up after that you may be able to say the statute of limitations has run. After that the debt is wiped clean from its books and the IRS writes it off. Generally speaking when it comes to a tax audit the IRS is only able to go back three years.

Learn more about the IRS Statute of Limitations here. A tax assessment determines how much you owe. IRC 6161 allows an extension to pay estate.

Prior to RRA 98 the IRS had much wider authority and virtually no time limit for collections activities. This means that under normal circumstances the IRS can no longer pursue collections action against you if. If there are substantial errors they may go back further but typically no more than.

How far back can the IRS collect unpaid taxes. But the agency cant chase you forever. Schedule payments up to 30 days in advance and receive instant confirmation that you submitted your payment Debit or credit card You can pay your taxes by debit or credit card.

The Internal Revenue Service IRS has a 10 year statute of limitations for which they can collect back taxes.

Irs Tax Expiration Exceptions Andretaxco Pllc

How To Find Your Irs Tax Refund Status H R Block Newsroom

Are There Statute Of Limitations For Irs Collections Brotman Law

Will The Inflation Reduction Act Increase Irs Tax Audits

The Proven Way To Settle Your Tax Debt With The Irs Debt Com

Irs Crypto Crackdown Likely To Be Delayed Giving Tax Cheats A Reprieve Bloomberg

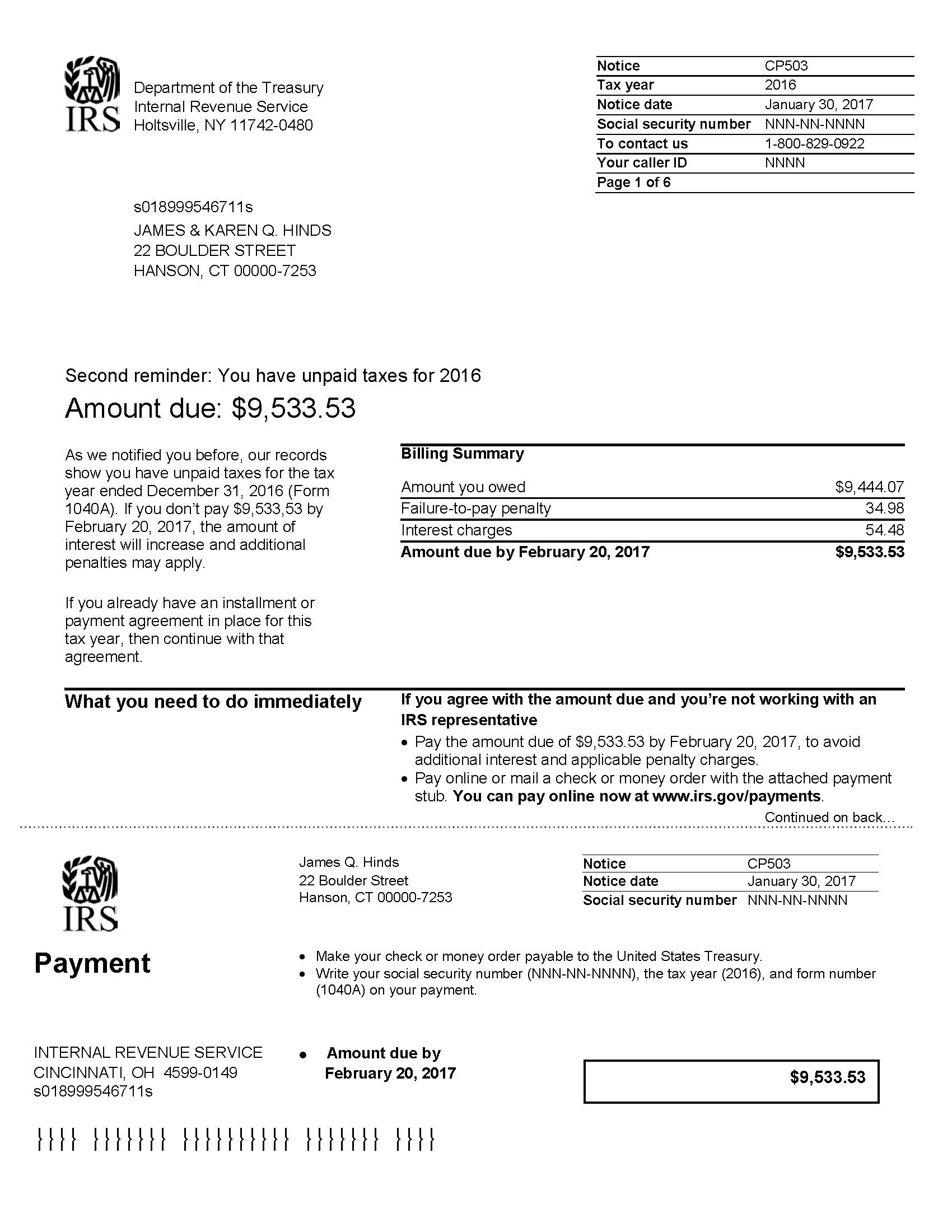

Irs Notice Cp503 Second Reminder For Unpaid Taxes H R Block

Why Did I Receive An Irs Cp14 Notice In The Mail Your Guide What To Do With The Irs Cp14 Letter Get Rid Of Tax Problems Stop Irs Collections

When Does An Irs Tax Lien Expire Rjs Law Tax And Estate Planning

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Irs Tax Refunds Will You Pay Taxes On Your Social Security Payments Marca

Asset Seizure What Assets Can The Irs Legally Seize To Satisfy Tax Debts

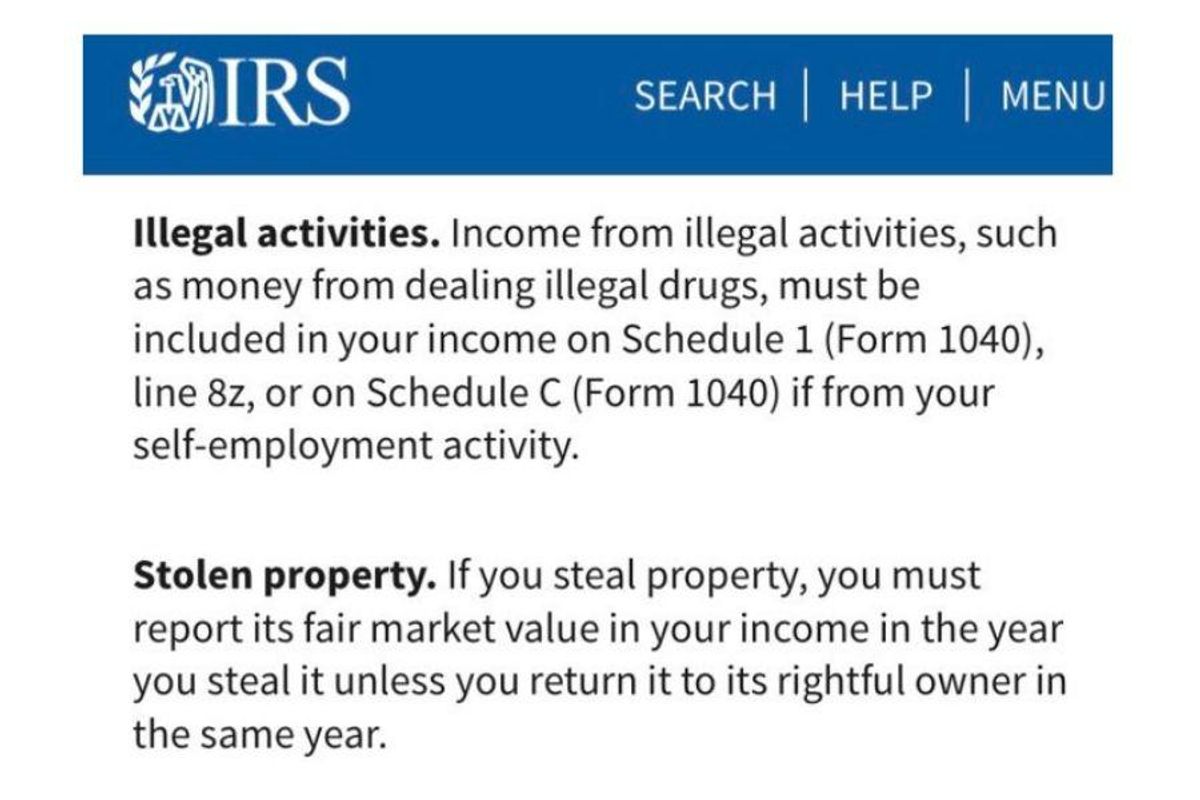

The Irs Says Criminals Have To Report Illegal Income Seriously Upworthy

2022 Irs Tax Refund Dates When To Expect Your Refund

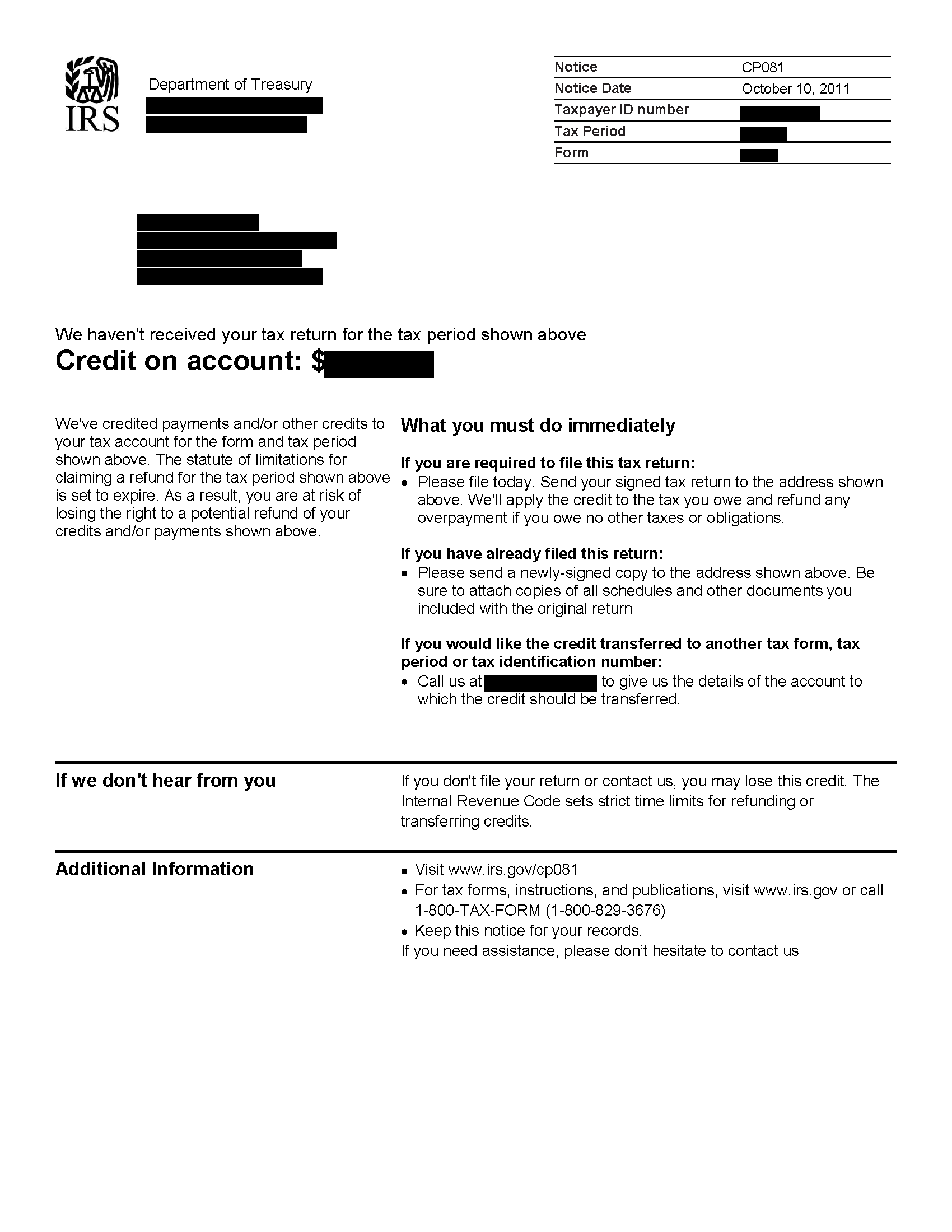

Irs Notice Cp81 Tax Return Not Received Credit On Account H R Block

Will The Inflation Reduction Act Increase Irs Tax Audits

How Far Back Can The Irs Collect Unfiled Taxes

How Do I Know If I Owe The Irs Debt Om

Tax Debt Settlement Everything You Must Know On Irs Tax Settlement Firms Blog